How the Affordable Care Act Changed the Face of Health Insurance

Why have health insurance rates gone up after the Affordable Care Act was implemented?

Source: Thinkstock

- The Patient Protection and Affordable Care Act (ACA) has revolutionized the health insurance industry in a number of ways. Its impacts have been vast and wide.

One of the most significant impacts of the landmark legislation is the upward trajectory of premiums, deductibles, and out-of-pocket costs, especially with plans sold on the health insurance exchanges.

At the end of last year, the Robert Wood Johnson Foundation released a report showing that the costs of premiums were expected to jump in 2016, driven by those plans being sold on the exchanges.

The Gold Plans will be hit the hardest with a 13.8 percent rise for monthly premium costs while for the Silver Plans, the premium rates are expected to increase by an average of 11.3 percent across the country.

The Bronze Plan lands right in the middle, with the rate expected to reach a 12.6 percent increase. Members who have purchased health plans on the health information exchanges but are not receiving federal tax subsidies have to pay higher monthly premiums than before.

The cost of deductibles is also rising significantly in a number of states including Washington, South Carolina, and Mississippi, according to the Robert Wood Johnson Foundation.

Why have health insurance rates gone up after the Affordable Care Act was implemented? What does this mean for health payers and providers?

Many of the ACA provisions have led health payers to spend more on covering medical services among the sickest populations while hospitals and emergency care providers no longer have to manage nearly as much uncompensated care due to Medicaid expansion and the individual mandate.

However, payers have created narrow provider networks to account for elevated spending, which are causing issues regarding referrals among physicians. Consumers are also faced with higher insurance rates than before.

The causes of higher premium rates

The rise in expenses may have a lot to do with the fact that this legislation has brought forward medical coverage for an additional 20 million people and abolished the pre-existing conditions clause. The risk pools for health plan populations are now much different than before and health payers are being required to cover the expenses of some of the more costly patients within the healthcare delivery system.

Additionally, the Affordable Care Act has required health plans to fully cover preventive services such as cancer screenings and immunizations. Some of the impacts from the Affordable Care Act have also led some insurers to invest in scale.

For instance, four major payers - Humana, Aetna, Anthem, and Cigna - are forming two mergers in order to stabilize costs of operating health coverage in the ever-changing healthcare landscape.

However, health insurance mergers and acquisitions may also play a role in increasing the costs of premiums. While payers claim that premiums will decrease due to mergers, the opposite may actually be true, stated the Harvard Business Review. When there is more competition in the market, there is actually a greater downward shift in medical costs.

Whether or not payers decide to invest in mergers and acquisitions, it is clear that the Affordable Care Act has produced a significant impact on the expenses of health insurance companies. Premium costs and other insurance rates are going up significantly among plans being sold on the health insurance exchanges, said Joel White, President of the Council for Affordable Health Coverage.

“Generally, what we see is an ever-increasing trend upwards,” White told HealthPayerIntelligence.com. “We’ve seen year-over-year price increases. Last year, we had an average premium increase of 11.3 percent for Silver Plans. We saw about a 20 percent increase in deductibles on the Silver Plans. Generally, across all plans, premiums were up as well as deductibles and cost-sharing were up in the double digit range.”

“We’re seeing a very similar trend for this year with the initial rate filings. You can go across states from Arkansas to Washington; we’re seeing big insurers come in with double digits. In some cases, they have shown more than 20 percent increases of premium rate filing.”

White also found that premium rates are ever-increasing around the nation ever since the Affordable Care Act took effect three years ago. While there has been a decline of premium prices within seven states, there were also double-digit rises in a total of 21 states, according to a report from The Commonwealth Fund.

“Those [jumps in premium price] are reflective of major increases of medical costs trend or the cost of providing services. Risk pool adjustments are not great and there is about half the projected enrollment. Originally, it was expected that there would be 21 million in the risk pool. There are about 10 million people this year - almost half,” said White.

The risk pool has changed significantly since the Affordable Care Act took effect since health payers are no longer allowed to utilize pre-existing condition clauses and young adults may remain on their parents’ insurance plans until 26 years of age. Additionally, the individual mandate has required the majority of Americans to enroll in health plans or else risk a tax penalty.

“All these factors are leading to a general trend ever since 2014 of double digit premium cost increases on average,” explained White. “HHS and other advocates have said, ‘don’t worry about the double-digit premium increases if you have premium subsidies if you’re low income and cost-sharing subsidies as well. Taxpayers will pick up the bill for those cost increases.’ In other words, if your premium was about $290 per month and you were at 200 percent of the federal poverty level, you’d only spend about $107 per month for premiums.”

“That’s true,” he acknowledged. “Congress enacted the law to provide premium subsidies. What they’re not saying though is that those costs don’t evaporate. They don’t go away. They get shifted onto taxpayers and taxpayers then pay the costs of those subsidies. A better strategy is not cost-shifting. It’s not a good cost containment strategy. Cost reduction is a good cost containment strategy.”

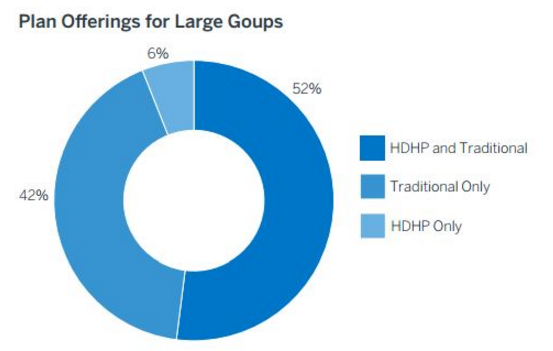

High deductibles are becoming more common

Along with the higher premium costs found among health plans sold on the exchanges, more payers have invested in implementing high-deductible health plans. The ACA may have led to higher deductibles and extensive out-of-pocket costs, stated Cindy Mann, a Partner at Manatt Phelps & Phillips.

“We’ve seen virtually no change in the employer-based market in terms of the availability of coverage to the employer-based market,” Mann said. “However, we’re beginning to see in the last few years in the commercial market are higher deductibles for people.”

Source: Benefitfocus

“Costs have been controlled by some degree by payers increasing the exposure to out-of-pocket costs by coverage,” she continued. “We’re seeing some amount of initial proposals on the exchange for premiums to rise. We’re seeing some exchanges where the proposals don’t show a significant increase in the premium. I think what we’re going to see next year among premiums on the marketplace will probably be mixed.”

“Different markets will have different pricing strategies. Lots of different factors are going on. Certainly, in the Medicaid program, the overall cost of the program is going up because it’s covering many more people, but the per enrollee cost has been averaging a little over 3 percent, which is modest.”

How the individual mandate affected the health insurance market

The biggest regulatory change that has dramatically transformed the health insurance industry is the individual mandate. The individual mandate requires every American to have health insurance or else face a tax penalty. This has led health payers to cover many more individuals and families than ever before, which is a major impact on the insurance industry and its revenue stream.

Because payers no longer have the opportunity to serve the only the healthiest and least expensive consumers, the industry is starting to focus its efforts on pay-for-performance reimbursement models.

“For the health insurance industry, there have been many more lives that can be covered because there is a source of subsidy for people to be able to purchase health insurance,” Mann explained. “Medicaid itself is dominated by private insurance plans. Most Medicaid beneficiaries are enrolled in managed care plans. Also, there’s the marketplace and people coming remaining on their parents’ plans up to age 26.”

“The biggest change is a large influx of new lives to be covered. It also changes the game for health insurers when there are fewer gaps in coverage and when there is payment for care that is provided, insurers can increasingly focus on how to improve quality and value and move to new kinds of delivery systems and payment arrangements which all depend on in large ways people having payment for services.”

“They all have to have coverage for it to happen,” she said. “The coverage game is linked to opportunities for health insurance plans to move forward on improving the way care is delivered and getting more value for the dollar spent.”

Essentially, Mann explained that, when payment for healthcare is assured and gaps are closed, providers and payers can focus their efforts on improving the quality of services, patient outcomes, and moving toward alternative payment models by embracing value-based care reimbursement.

On the other side of the equation, when the Affordable Care Act implemented the individual mandate and eliminated pre-existing condition clauses, the risk pool health payers manage changed drastically and led many health insurance companies to lose money selling plans on the exchanges.

The consumer market opens up

Now that payers are incentivized to change their reimbursement strategies and push for more efficient preventative care, there is more focus on consumer engagement, says Jose Vazquez, Vice President of Solutions at the University of Maryland Medical System.

“There is now a drive for greater transparency of information from a financial and quality standpoint for consumers,” Vazquez said. “As individuals are starting to make more and more of their own health decisions when it comes to choosing a benefit plan and a potential shift of employers offering a subsidy for a health premium as opposed to offering health insurance, we’re looking at a potential shift toward the consumer.”

“Whereas the majority of the commercial market may be driven by small business policies, we’re now gaining a new consumer and new perspective that needs to be rolled out,” continued Vazquez. “This includes everything from the initial signup and selection of a plan to the actual execution of the plan’s benefits and information available to a member.”

The impacts of voluntary Medicaid expansion

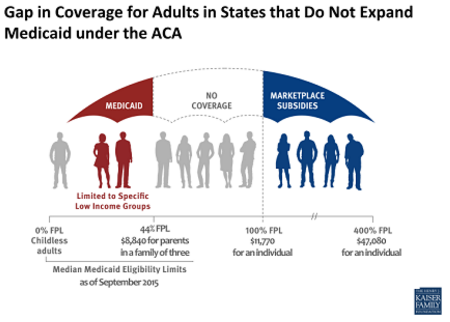

While the individual mandate of the Affordable Care Act is meant to bring healthcare coverage to as many eligible Americans as possible, there are still some regulatory hurdles standing in the way for many potential consumers. In 2012, the Supreme Court passed a ruling stating that state Medicaid expansion would be optional under the Affordable Care Act.

At this point in time, 19 states have still not expanded their Medicaid program despite the fact that the federal government would cover more than 90 percent of the costs associated with this expansion. When comparing the populations in states that have not expanded Medicaid to the 31 states that took part in Medicaid expansion, there is a significant difference in healthcare access and the drop in uninsured rate.

“So far, 31 states and the District of Columbia have expanded,” Mann said. “Before the decision, all the states were planning to expand. Some liked it and some didn’t like it, but they were all planning to do it. Then the Supreme Court decision came down in 2012 and made it voluntary with states.”

“A lot of stakeholders going into the Affordable Care Act discussion thought that poor people had coverage, older people had coverage, but people in the middle were missing out on coverage,” Mann said.

“Certainly, lots of people in the middle were missing out on coverage, but the reality is that poor people did not have healthcare coverage before the Affordable Care Act in most states. Only certain pockets of poor people had coverage. Kids had strong coverage rules in place for Medicaid and CHIP. In most states, if you were at even 50 or 60 percent of the poverty line raising kids, the parents weren’t eligible for anything.”

Within the states that haven’t expanded Medicaid, many low-income individuals still lack healthcare access. There is still a coverage gap found in states without Medicaid expansion and patients still face the same barriers to primary care access that made care delivery difficult before the ACA, said Mann.

Source: Henry J. Kaiser Family Foundation

“In the 19 states though, we still have the same situation where people are not eligible for coverage even if they have very low earnings or they’re unemployed,” Mann stated.

“It’s really a tale of two sets of states with one where there is a continuum of coverage and subsidies including Medicaid, CHIP, and the marketplace and one where there is a big hole and people above 100 percent of poverty can get insurance through the marketplace, but people under that who are poor will have too high an income to qualify for Medicaid and too low in income to qualify for the exchange.”

Preventive medicine provisions incentivize accountable care

The ACA has also brought provisions that require health payers to fully cover preventive services such as immunizations and cancer screenings. This completely eliminates out-of-pocket expenses for consumers who are seeking preventive care and provides a clear incentive for patients to pursue preventive medicine.

“[New reimbursement structures are] being pushed by the ACA and market forces,” Mann stated. “There is a growing consensus that we really do need to move to providing more emphasis on primary preventive care and, for the chronically ill or disabled, care management and more integrated delivery systems so that we’re not just treating people when they’re sick but we’re caring for people and helping them keep as healthy as can be.”

“That has enormous potential benefits for consumers. The availability of primary and preventive care without cost really opens up services to people that otherwise were price sensitive and were discouraged from accessing.”

The Affordable Care Act has also led to the design of accountable care organizations (ACOs) and the Medicare Shared Savings Program. In general, federal legislation such as the prior meaningful use requirements have brought a greater focus on reforming the healthcare industry into a system that incentivizes quality over quantity.

This has included the incorporation of new technologies such as electronic health records and data analytics software as well as general strategies to improve care coordination and implement new models of healthcare delivery.

These include accountable care organizations (ACOs). ACOs are founded on the idea that care coordination between specialists, primary care doctors, hospitals, and health payers will help to boost quality by preventing patients from falling through communication gaps along the care continuum.

“I think accountable care organizations and other entities that are trying to create integrated systems of care, so that they’re not just treating you when you’re sick but are responsible overall for your health and responsible for the total cost of care, makes everybody behave differently in terms of looking out for the consumer,” said Mann.

“There is also the growing interest in having the consumer be more engaged in how care is delivered and what the arrangements are in terms of care coordination,” she continued.

Consumer engagement and consumer choice is becoming more prevalent among health plans as well as the entirety of the care delivery continuum. With some payers losing revenue in the new healthcare landscape, the clear choice is to embrace consumer engagement and preventive medicine in order to create a healthier population while reducing spending.

Accountable care organizations are being adopted to achieve these goals. Today, there are 833 ACOs operating across the United States, according to a report from Leavitt Partners and the Accountable Care Learning Collaborative.

“It’s just emerging. A lot of the ACO activity is in formation. There is a significant number operating around the country. I think these impacts are not sold broadly yet by consumers, but they will increasingly change the landscape of how healthcare is delivered and paid for with a significant impact on consumers.”

While there are clear benefits to ACOs in terms of the quality of patient care and coordination between medical teams, the cost savings associated with accountable care organizations have not been as high as once hoped.

“The big thing that the administration was pinning their hopes on was the accountable care organization,” Joel White of the Council for Affordable Health Coverage said. “We know in the Medicare program, the ACOs have saved approximately $500 million, which put in context in Medicare is about 0.0026 percent of total program spending. So it’s almost nothing. It’s a blip. It’s almost like an experiment or demo project.”

“Part of the reason for that is that there is no real patient engagement,” he pointed out. “For example, Medicare beneficiaries don’t share in the savings like doctors do. If they did, they’d probably have more incentive to engage in better behaviors or engage in their own care in ways that help improve outcomes and lower cost. There were high hopes going into it that these reforms would really impact the system. I think at the end of the day, at the practical level, at the consumer or individual level, not much has changed.”

Despite fewer cost savings than initially planned, the push for ACOs and the Medicare Shared Savings Program has stimulated more private payers to invest in pay-for-performance reimbursement contracts and accountable care. In addition, due to the ACA’s health insurance exchanges, payers are now more focused on meeting consumer needs and strengthening patient engagement in wellness.

Research published in the International Journal of Health Policy and Management outlines the importance of consumer choice in health plan benefits and the need to incorporate both individuality and the consumer’s voice when creating insurance products for sale.

This means that payers are likely to work with ACOs in the coming years to strengthen patient engagement and potentially produce more cost savings. The general trend toward embracing value-based care reimbursement is also positioning health payers and providers to reduce overall healthcare spending.

While the Affordable Care Act has led to a rise in health insurance rates particularly premium costs and deductibles, it is bringing health payers to adopt value-based care contracts and partner with accountable care organizations in order to improve quality and lower costs.

It is also vital to note that an additional 20 million more Americans now have healthcare access due to the individual mandate of the Affordable Care Act. This landmark legislation is leading healthcare to become a right in this country instead of a privilege.

Through the inclusion of consumer engagement strategies and a focus on preventive, accountable care as well as the movement toward value-based care reimbursement, health payers could overcome the obstacles associated with ACA provisions and stabilize increasing health insurance rates.