Retail Clinics, Surprise Bills Changing Healthcare Purchasing Patterns

The growing availability of retail clinics, combined with frustration over surprise bills, may be changing consumer healthcare purchasing patterns.

Source: Thinkstock

- Consumers are changing the way they spend their healthcare dollars as the stress of surprise medical bills, coupled with new retail-style options, change the care delivery landscape.

Two new consumer surveys reveal that changing healthcare purchasing patterns could be a challenge for payers that are not nimble enough to adapt to emerging habits and increasing demands for simplicity, transparency, and convenience.

Surprise bills and unexpected costs are putting consumers off the idea of engaging regularly with the traditional healthcare system, says a poll by HealthSparq.

In the past twelve months, more than half (53 percent) of respondents to the survey received an unexpected bill for a healthcare service.

Sixty-two percent of those individuals received bills for services they thought were covered by their insurance plans.

READ MORE: Consumers Struggle with Health Plan Finances, Healthcare Literacy

Sixty percent said their surprise bills were higher than expected, while 42 percent received multiple bills from more than one provider when they expected just one payment.

The frustration and anxiety around surprise billing is leading consumers to alter their healthcare spending habits.

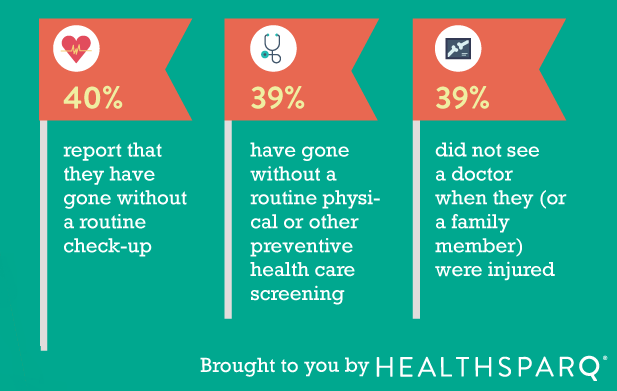

Skipping routine care is a direct result of opaque and confusing billing processes, the survey said. Forty percent of consumers have skipped a routine check-up, physical, or other preventive screening to avoid the stress of billing.

Source: HealthSparq

Thirty-nine percent have even avoided care when they or a family member is sick or injured due to their aversion to interacting with the medical billing system.

While payers are not the only entities responsible for unclear or unexpected bills, they do tend to bear a significant portion of the blame.

READ MORE: Health Plan Cost Sharing, Deductibles Outpace Members’ Wage Growth

In the HealthSparq survey, 45 percent of participants pointed to their payers as the source of the problem.

However, in a recent poll from NORC at the University of Chicago, that number jumped to a whopping 86 percent of beneficiaries.

Generalized mistrust in payers, combined with the challenges of understanding health benefits and coverage options, can lead to deteriorating relationships with insurance companies, NORC indicated.

As a result of the discomfort of exposing themselves to financial uncertainties, consumers may be more likely to turn their attention to an increasingly popular option for non-urgent care: the retail clinic.

Retail clinics have popped up in communities across the country in recent years, multiplying five-fold since 2010, says Civis Analytics in a new report.

READ MORE: Humana, Walgreens Offer Primary Care Clinics for Medicare Members

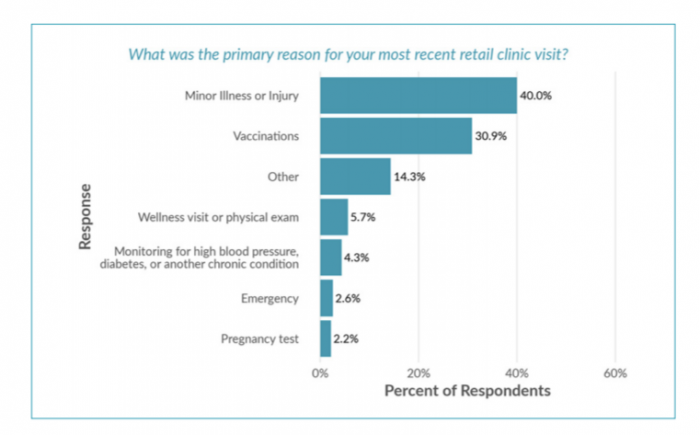

Younger patients in good health – the same demographic that might not worry too much about skipping an annual physical – tend to use these smaller, low-cost care sites at a higher rate than other consumers.

More than a third of retail clinic users are irregular patients or first-time visitors, the survey said, who tend to visit clinics upon recommendations from family and friends or seeing a clinic is available while conducting other daily activities.

The convenience factor is high, with speedy appointments and up-front billing for out-of-pocket payments.

While retail clinics are not yet replacing relationships with the primary care ecosystem, they are acting as an effective supplement for traditional care that sometimes fills gaps in access or availability.

Most patients wait for less than 15 minutes to be seen by a nurse practitioner or physician assistant, and many consumers were able to get shopping done at the same time in the co-located pharmacy or big-box retail outlet.

Sixteen percent of retail clinic users said the option was cheaper than receiving comparable care at their primary care provider, while 25 percent turned to retail clinics after failing to secure an appointment at with their PCP.

Almost ninety percent of consumers who have visited retail clinics are commercially insured, yet around 10 percent are using retail clinics for wellness visits and chronic disease management.

Source: Civis Analytics

“This suggests that even people with health insurance want more convenient, lower-cost options for medical services,” the report says. “This trend makes sense because many patients are covered by plans that require them to bear more of the cost, such as high-deductible health plans (HDHPs).”

Avoiding the complexity of challenging billing processes and surprise payments – while simultaneously accessing satisfactory care in an expedient manner – is an attractive proposition for many beneficiaries.

"Today, people seeking healthcare have more options for where to get it, and providers have to appeal to them not only as patients but as consumers as well," said Crystal Son, Healthcare Analytics Lead at Civis Analytics.

"Patients want good medical care, but they also value convenience and want healthcare to meet them where they are, rather than cause disruption to their daily lives. Retail clinics are in a good position to meet both of these desires."

Payers looking to control spending through preventive care and chronic disease management will need to take these new trends and challenges into account as they design plan options for the next several years.

In addition to growing frustration with surprise billing processes, beneficiaries are becoming more averse to high-deductible plans that can result in sticker shock for even the most basic of services.

The lure of a flat fee and transparent pricing menu from a retail clinic for routine services and preventive care could result in a shift away from traditional arrangements and purchasing patterns.

Creating more manageable financial structures for beneficiaries – and improving the availability of education about a member’s financial responsibilities – may help to contain the fragmentation of care delivery between primary care offices and retail outlets.

Payers that are unable to meet changing beneficiary demands for convenience and price transparency may find themselves in a difficult position when it comes to maintaining membership or recruiting new customers.

Being proactive about designing consumer-friendly, convenient, and easy-to-navigate benefits may be the difference between financial success and falling behind competitors in the current pressure-cooker insurance marketplace.